In Business, a part of the wild success will always remain a mystery. Still, trouble brewing will inevitably end up on the table of the Chief Executive Officer (CEO), and rightly so.

The Primary Role of the CEO is Capital Allocation (Monetary + Human), and somewhere Alphabet CEO seems like a Day 2 Manager in this regard.

The CEO seems clueless about employees, and personnel problems are spilling into the public domain. Recently the way the layoffs were done speaks volumes about the leadership challenge. Capitalism, without releases, is talking about religion without hell, but the approach could have been more humane.

Google is a pioneer in AI, yet ChatGPT comes from nowhere and hits the Leadership. If media reports are to be believed, a Code-Red was issued, and even help from the founders was sought. This all shows only one thing… Sleep till awaken.

All this only confirms the Day 2 Manager theory. Now Microsoft pumping Billions of Dollars in ChatGPT has only increased the headache, but as Munger says, when you could fix a problem, you let it drift, then you very well deserve the trouble.

Most of the problems which Google faces today are essentially management flaws, which are just getting highlighted. Jason Zweig brilliantly puts it, “No strategy can erase decades of bad decisions,” now put with its decades of complacency bred in like a govt setup. It is a classic case of a disaster waiting to happen. Let us delve a bit into the Business of Alphabet to have a deeper understanding and note that all is still not lost, provided they get their act together.

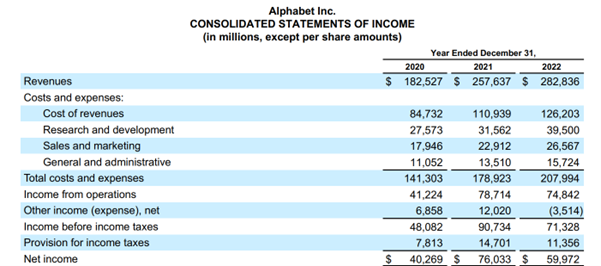

The overall Net income has shown a massive decline from 76 billion to 59 billion, coupled with slowing revenues, as the YOY growth has been mere 9.78% from 2021 to 2022.

We will need to investigate a little more so that the magnitude of Armageddon is evident. The pertinent question is: What is slowing sales, where is the highest cost burden, and what is over-indulgence?

We will start by looking deeply into the Break-up of Revenues and slowly take it to a logical conclusion.

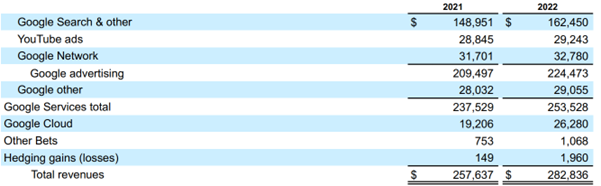

The Data is so precise that the YT revenue is stagnant, indicating heavy competition from TikTok, and the Google Network engine has also remained flat.

This company remains a search box around which all the hoopla seems to be happening, and luckily search appears to be growing even on a higher base.

The following pertinent point is that Google Cloud is still not a positive print on the Operations level. The growth has been robust, but the losses have remained the same.

The other bets are a sinking fund hoping for a Kohinoor diamond somewhere in the Atlantic. It is necessarily evil because of the nature of the Tech business. Still, a directed effort would be better than treating this as an engineering paradise in the hope of a breakthrough making their way to heaven, but in the process, not even achieving the basics of life.

THE GREAT INCREMENTAL CAPITAL MONEY MACHINE

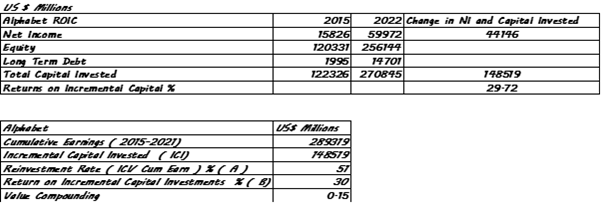

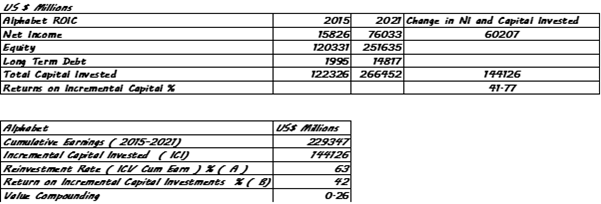

The Return on Incremental Capital is around 30%, but the Value compounding is merely 15% which is nothing terrible, but for a firm like Alphabet, this surely pales. The biggest culprit has been the decline in Net income. If we only eliminate the year 2022 and stick to 2021, the figures translate to a better view.

The Incremental Capital moves up to 42%, and Value compounding jumps to 26%. Overall, the Business is terrific, but no business, however excellent it is, can be managed with this kind of Day 2 management. The decline will be rapid and breathtaking.

The rise of Alphabet from when Sundar took over has been brilliant, but then Charlie Mungers quote becomes most appropriate here… Bull markets go to people’s heads. If you are a duck on a pond, and it is rising due to a downpour, you start going up in the world. But you think it is you, not the pond.

The Mettle to prove your worth is today, not when the Ad Market is booming, spending is growing in double digits, today you have Microsoft behind your back with ChatGPT, Amazon behind your back with its growing Ad Business, and Cloud Business is highly competitive, please turn that into a positive print.

Your Capital Return program is healthy, continue and aggressively invest in your shares, eat up your claims, and invest where the payoffs are soon, not some distant future.

Make sure to recruit and do not go overboard prudently, and overall display courage and strength; you are the leader of Alphabet, which is a sublime firm; do not act meek.

A visit to Omaha will benefit you personally, do not be afraid to ask for help; there cannot be a better start than the one we leave you below with.

Warren Buffett on Capital Allocation. 1987 Letter.

The heads of many organizations are not gifted in capital allotment. It is not surprising that they are inadequate. Most bosses succeed in areas like marketing, production, engineering, administration, or institutional politics. They are confronted with new responsibilities as CEOs.

They are now required to make decisions regarding capital allocation, a crucial task that they may never have attempted before and is challenging to master. To extend the argument, it would appear that a highly talented musician had to be appointed Chairman of the Federal Reserve rather than performing at Carnegie Hall.

The absence of expertise that numerous Presidents have at capital distribution is no little matter: A CEO whose company annually retains earnings equal to 10% of net worth will have been in charge of deploying more than 60% of the Business’s Capital after ten years.